Missed EMI Impact on Credit Score:Every Borrower Must Know

Missing an EMI may feel like a small delay, but lenders and credit bureaus, it signals risk. Even one missed payment can lower your credit score, reduce your credibility as a borrower, and make future loans more expensive or harder to secure. What seems like a temporary cash-flow issue today can leave a long-term mark on your credit report. Understanding this impact early helps you protect both your financial health and your business growth.

What is a Credit Score and What Does a Missed EMI Mean?

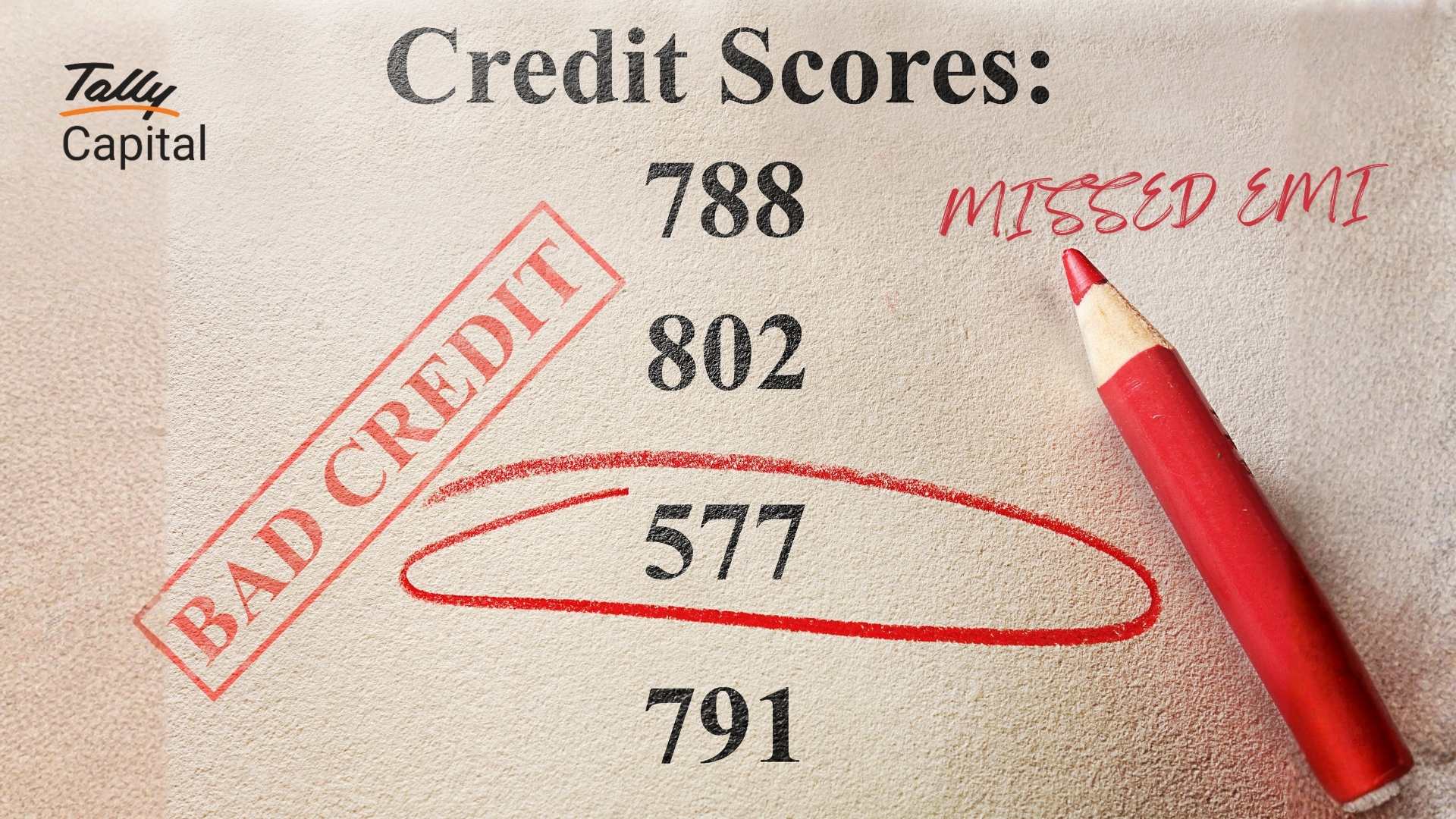

A credit score is simply a three-digit number that shows how responsible someone has been with borrowed money. In India, this number usually ranges from 300 to 900. A score above 750 is generally seen as strong and reliable in India. Lenders feel comfortable giving loans to someone with a good score because it shows a history of timely repayments.

This score is built mainly on repayment behavior. Banks and financial institutions regularly report whether EMIs were paid on time, delayed, or missed. When payments are made consistently before or on the due date, the score improves. When payments are delayed or skipped, the score drops.

A missed EMI simply means the payment was not made by the due date. Even if the delay is unintentional, it gets recorded in the credit report. That record does not disappear quickly. It can remain visible for several years. So, what feels like a temporary issue in business cash flow can become a long-term financial mark.

How Missed EMIs Hurt Your Credit Score

Credit scores are largely based on repayment history, which makes timely EMIs critical. When you miss or delay a payment, banks immediately report it to credit bureaus. Even a single missed EMI can reduce your score by 50–70 points, shifting your profile from low risk to uncertainty.

Once your score drops, the consequences follow quickly. Loan approvals slow down, interest rates rise, and lenders may reduce the amount they’re willing to offer or decline applications altogether. Since these records remain on your credit history for years, repeated delays can make borrowing costlier and restrict funding when your business needs it most.

Simply put, consistent EMI payments are one of the easiest ways to safeguard both your credit score and your access to capital.

Tips to Improve Your Credit Score and Avoid Multiple Missed EMIs-

Pay every EMI on time going forward

Consistency is the strongest signal of financial discipline. Regular, timely payments gradually rebuild your credit profile and restore lender confidence.

Set up auto-debit instructions

Automating EMIs reduces the risk of missed due dates. It removes dependency on memory and ensures payments happen even during busy business cycles.

Borrow within realistic limits

Choose loan amounts based on stable cash flow, not maximum eligibility. Comfortable EMIs reduce financial pressure and lower the risk of delays.

Maintain an EMI emergency buffer

Keep at least one or two months’ EMI amount reserved. This safety cushion helps manage temporary slowdowns without affecting repayment schedules.

Monitor your credit report regularly

Check for reporting errors or incorrect late-payment entries. Early detection allows timely correction and prevents unnecessary score damage.

Communicate early if cash flow tightens

If repayment challenges are expected, approach the lender before missing a payment. Timely communication may open options like restructuring or temporary relief.

Stay disciplined and patient

Credit repair takes time. Steady financial habits over months can gradually restore your score and strengthen your borrowing capacity.

How TallyCapital Helps Businesses Stay Credit-Healthy

Missed EMIs often happen due to poor planning, not negligence. TallyCapital helps businesses make informed borrowing decisions from the start by allowing them to check credit score, loan eligibility, and approval chances before applying. This prevents unnecessary loan applications that could negatively impact credit scores and helps borrowers approach lenders with better preparation.

The platform also compares EMIs, tenures, and offers from multiple lenders, so businesses can choose repayment terms that fit their cash flow. With flexible tenures and access to a free credit report with improvement insights, business owners gain better control over their finances, reduce repayment stress, and lower the risk of missed EMIs which supports stronger, long-term credit health

Conclusion

A delay or missed EMI may seem small in a busy month, but its effect on your credit score can be long-lasting. It affects borrowing power, interest costs, and future opportunities. For business owners, credit health is as important as profit margins. It influences how easily funds can be accessed when the business needs them most.

Financial discipline does not require complicated strategies. It requires awareness, planning, and consistency. Paying EMIs on time, borrowing within limits, and regularly checking credit reports are simple habits that protect long-term growth. With the right guidance and smart tools, businesses can avoid unnecessary credit damage and build a strong financial reputation. Because in business, opportunities often come suddenly. And when they do, a healthy credit score ensures that funding support is ready when needed.

Latest Blogs

Missed EMI Impact on Credit Score:Every Borrower Must Know

How Personal Credit Score Affects Business Loan Approval

Credit Score for Business Loans: Get Faster Disbursals

What Causes a Sudden Drop in Credit Score? Common Reasons Explained

Credit Score Guide for Small Business Owners in India

9 Credit Score Mistakes MSME Owners Make