Credit Score Guide for Small Business Owners in India

Running a small business in India? then you must have heard this line before:

“Sir your loan will not get approved because your credit score is less”

For many business owners, this becomes a shock. Sales are good, business is running, cash flow is coming in, so why is a credit score stopping a business loan?

The truth is simple. Today, your credit score plays a huge role in deciding whether you get a business loan, how much you get, and at what interest rate. And yet, most small business owners don’t fully understand how it works. This credit score guide for business owners will help you understand credit score better.

What Is a Credit Score for Small Business Owners?

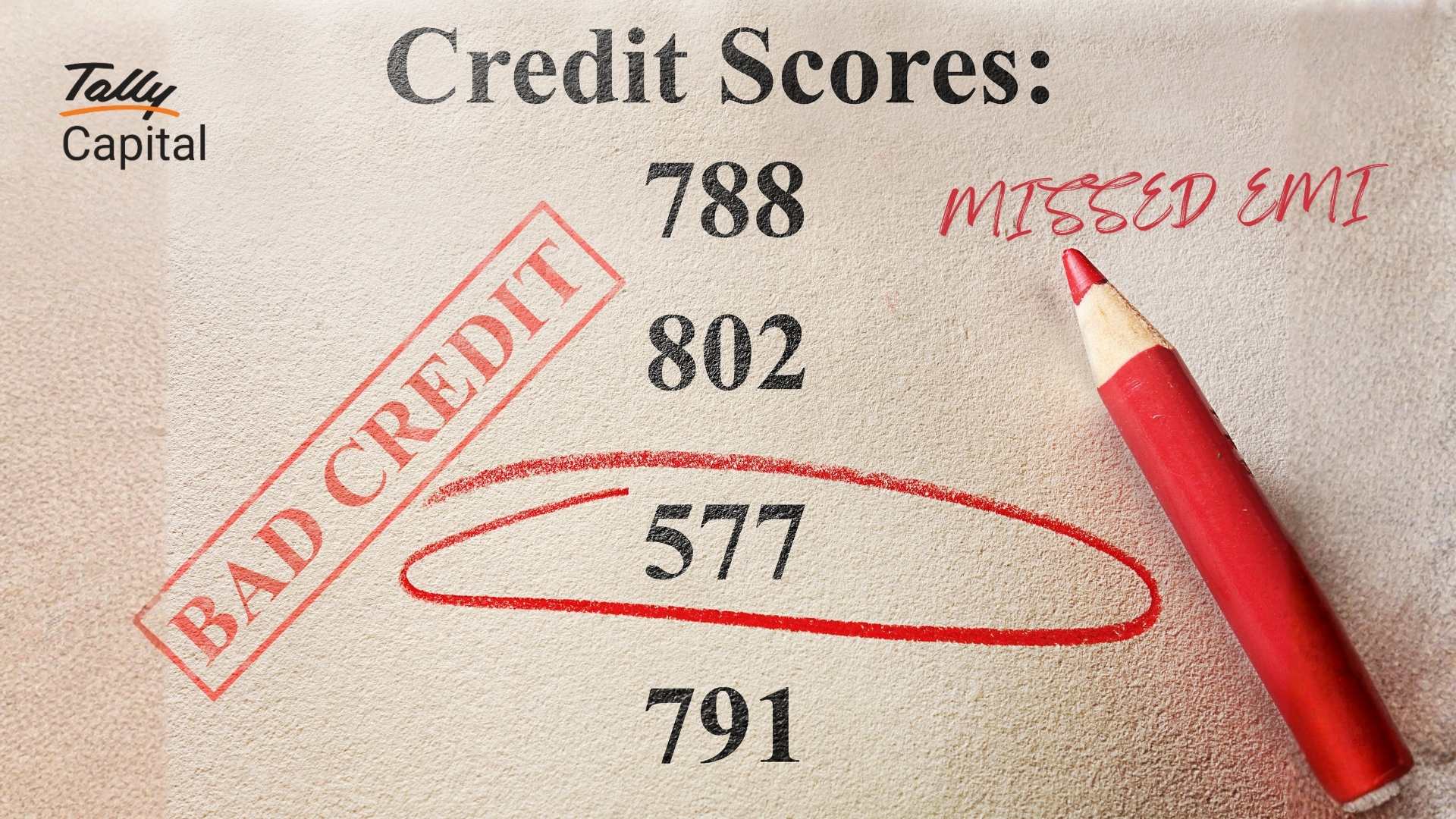

A credit score is simply a number that shows how responsibly you handle borrowed money. In India, this score usually falls between 300 and 900, and it plays a much bigger role in business loans than most owners realize.

Here’s an important point many small business owners miss. Even when you apply for a business loan, lenders usually check their personal credit score first. This includes your past home loans, personal loans, credit cards, and even BNPL or pay-later accounts.

The reason is straightforward. In small businesses, the owner and the business are closely connected. If personal EMIs are missed or delayed, lenders assume there is a higher risk that business loan repayments may also be affected. That’s why your personal financial habits directly influence your business loan approval.

Now let’s talk about what score works in your favor

A credit score above 750 is generally considered good for business loans because it gives lenders confidence in their repayment ability and usually helps you get better interest rates.

When your score touches 800 or more, you move into a very strong position and are seen as a preferred borrower, which means easier approvals and more flexible loan terms. If your score falls between 650 and 749, getting a loan is still possible, but you may face higher interest rates or a reduced loan amount. Scores below 650 make approvals difficult and significantly limit your options. While there is no such thing as a perfect credit score, anything above 800 places you among the safest borrowers in the eyes of lenders.

Why Small Businesses Need a Good Credit Score

A good credit score is not just about getting a business loan approved. It influences the interest rate you pay and the amount you receive. Even with healthy turnover, a low score can lead to rejection or costly terms. On the other hand, a strong credit score builds lender confidence, helps you secure lower interest rates, higher loan limits, and makes borrowing smoother and less stressful overall.

How Credit Score Affects Business Loan Eligibility

Let’s understand this with a quick example

Rohit and Amit both run similar businesses and apply for a ₹10 lakh loan.

Rohit has a credit score of 780, so he gets a lower interest rate of 14% and an EMI of around ₹23,300. Amit’s credit score is 620, and because of that, his interest rate goes up to 22%, making his EMI nearly ₹27,600. The loan amount and tenure are the same, yet Amit ends up paying thousands more every month. This is the real cost of ignoring your credit score.

Common Reasons Why Small Business Credit Scores Drop

- Most of the time, credit scores don’t fall because of big mistakes. It drops due to small habits repeated over time, such as missing or delaying EMIs. Even one or two late payments can hurt badly.

- Overusing credit cards is another issue. When your card is always close to the limit, it signals financial pressure.

- Too many loan enquiries in a short time also reduce your score. Applying everywhere out of desperation often backfires.

- Lastly, mixing personal and business expenses without planning creates chaos and missed payments.

How to Improve Credit Score for Business Loans

Improving your credit score is possible, but it requires patience, consistency, and financial discipline. Here’s how you can do it step by step:

- Pay all EMIs on time:

Timely repayment is the most important factor in your credit score. Even paying just the minimum due on credit cards helps avoid negative marks on your report.

- Control credit card usage:

Try to use less than 30% of your total credit limit. High usage signals financial stress and pulls your score down, even if you pay on time.

- Avoid multiple loan applications together:

Applying for several loans at once leads to multiple credit enquiries, which can reduce your score. It’s better to apply strategically after proper guidance.

- Check your credit report regularly:

Sometimes reports contain errors like wrongly marked late payments or closed loans showing active. Correcting these mistakes can give your score an instant boost.

How Long Does It Take to Improve a Credit Score?

Small improvements can be seen in 2–3 months if payments are regular. Major improvement usually takes 6–12 months, depending on past mistakes.

There is no overnight fix. Anyone promising instant credit score repair is usually misleading you.

Credit Score Myths Small Business Owners Believe

Many small business owners make financial decisions based on half-information or things they’ve heard from friends, relatives, or even local agents. Over time, these myths create unnecessary fear around credit scores and business loans. The problem is not the credit score itself, but the misunderstanding around how it actually works. Let’s clear some of the most common myths that often confuse small business owners.

- Myth: “Credit score doesn’t matter if my business is running well.”

Reality: Turnover and profits are important, but lenders also check your credit score. Both work together for loan approval.

- Myth: “Checking my credit score will Lower it.” Read a full blog on this

Reality: Checking your own credit score is completely safe and does not affect it in any way.

- Myth: “Closing old loans improves my credit score.”

Reality: A long and clean repayment history strengthens your credit score, so old well-managed loans are helpful.

Understanding these myths correctly can save you from wrong decisions and help you approach business loans with more confidence and clarity.

Final Thoughts: How TallyCapital Helps

A business loan should help your business grow, not become a burden.

At TallyCapital, we don’t just push loan offers. We first understand your credit profile, explain where you stand, and guide you on how to improve it if needed. Sometimes, waiting and fixing your score saves you lakhs in interest.

Your credit score is not a problem. It’s a tool. Use it wisely, and it can open doors to better business opportunities.

If you want the right guidance for your business loan journey, TallyCapital is here to help step by step.

Latest Blogs

Missed EMI Impact on Credit Score:Every Borrower Must Know

How Personal Credit Score Affects Business Loan Approval

Credit Score for Business Loans: Get Faster Disbursals

What Causes a Sudden Drop in Credit Score? Common Reasons Explained

Credit Score Guide for Small Business Owners in India

9 Credit Score Mistakes MSME Owners Make